A Fresh View of the Children’s and YA Book Market:

The first annual report on the sales of children’s and young adult books in BookCity stores has been released. Based on data collected and analyzed from 28 BookCity branches across the country, the report reveals that young readers show a strong preference for translated works, while original Persian titles continue to hold a more limited share of family purchases.

This inaugural report provides a fresh and accurate picture of family and adolescent book-buying behavior in 2023. The dataset, compiled from BookCity branches in Tehran and other provinces, covers 1,752 children’s and young adult titles. Such reporting reflects BookCity’s renewed strategy to take children’s and adolescent reading more seriously, recognizing this audience as not only the most dynamic in the market but also the foundation of tomorrow’s cultural life. Alongside its retail role, BookCity is also shaping itself into a hub for social work, educational dialogue, and cultural well-being, making book data part of a larger civic mission.

Each year, various organizations publish recommended book lists for children, teens, and parents. Yet, market reality often diverges from these lists. The BookCity report notes, for example, that 45% of the best-selling children’s titles are absent from the “Flying Turtle” list, and 49% of best-sellers are not included in the Children’s Book Council’s recommendations. Advertising, access, and personal preference appear to be major factors shaping the gap.

One of the central challenges has been the lack of reliable, publicly available sales statistics. At present, most data is held by large publishers and major distributors. By releasing this report, BookCity takes an important step toward building a transparent and reliable picture of the children’s and YA book market.

“Children’s and young adult books are the cultural capital of our future. If a child enjoys a meaningful experience at BookCity today, that bond will carry into tomorrow. Transparency in sales data and thoughtful market analysis can help publishers provide better products and inspire a new generation of readers.” — Ali Jafarabadi, BookCity CEO

Perhaps the most striking finding is the overwhelming popularity of translated titles. In the children’s category, 83% of the top sellers were translations, while only 17% were original Persian works. Among teens, the figure climbs to 97% translated versus just 3% local authorship. This dominance is particularly evident in adventure, fantasy, and humor genres.

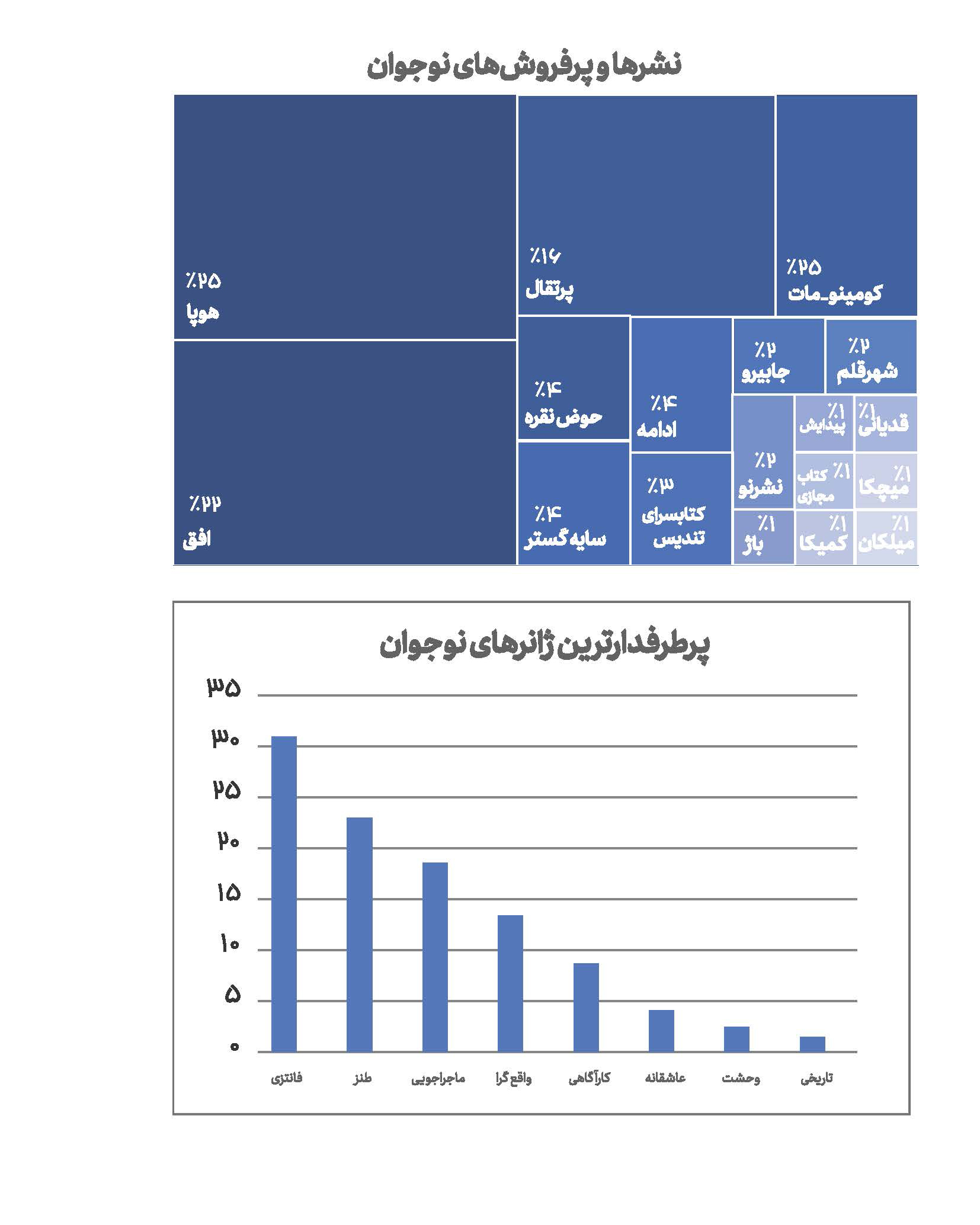

In the children’s segment, simple stories, educational activities, and picture-book series remain the best sellers. For adolescents, multi-volume series, sequels, and even Japanese manga (some excluded from the statistics due to licensing issues) are gaining traction. According to the data, 46% of children’s readers choose fiction, 30% prefer poetry, and 24% select non-fiction. Among teens, fiction accounts for more than 90% of purchases, while poetry and non-fiction together make up less than 10%.

The strength of this report lies in its broad geographical coverage. BookCity collected data from major Tehran outlets—such as Central, Tajrish, Pasdaran, Ibn Sina, Niyayesh, and Goldis—as well as regional branches in cities like Isfahan, Qazvin, Qom, Ilam, and Sari. This diversity ensures that the findings reflect a wide social spectrum rather than a single demographic slice.

“This is the first time sales data on children’s and YA books have been released publicly and in an organized way. Our goal is to provide transparent inforamtion to help publishers, authors, and booksellers understand their audiences better. Regular reports like this can serve as a roadmap for improving services and strengthening sales.” — Tayebeh Ejei, Project Director

While many publishers are active in the field, a small number dominate the market. In children’s books, Ofoq leads with a 30% share, followed by Porteghal (20%) and Shahr-e Ghalam (14%). Smaller houses such as Ba Farzandan, Amirkabir, Ghadir, Fatemi, and Mehrsa each hold less than 10%.

In the teen segment, Houpaa and Kumino-Mat each lead with 25%, followed by Ofoq (22%) and Porteghal (16%). The strong presence of publishers like Kumika highlights the growing appetite for comics and Japanese manga among Iranian teens. Overall, the market distribution remains highly uneven, with a handful of private publishers commanding most of the share through savvy marketing and professional design, while specialized small presses still struggle for visibility.

For years, transparent statistics on children’s and YA book sales were unavailable to the public. With this report, BookCity has taken a major step toward building accountability and enabling better decisions for publishers, writers, and even parents. Future editions are planned with more comprehensive data, deeper analysis of emerging genres such as manga and graphic novels, and an exploration of how advertising and social media shape the market.

As Ejei concludes: “This year’s report is just the beginning. The more data we collect, the sharper our analysis can become. These insights will help publishers produce works that align more closely with reader needs, and guide parents and teachers to make more informed choices.”

BookCity intends to publish this report annually. The effort underscores its long-term strategy of investing in children’s reading culture, supporting adolescents as independent readers, and strengthening its role as not just a bookstore chain, but a cultural and social platform committed to the future of Iranian society.

Tags: BookCity, Children's Book, Research